I am tired. There, I said it.

I am tired of being “told” to use hand sanitizer when I enter

every business. I have eczema on my hands, you might as well light me on fire –

because that is what alcohol feels like on my skin. Even when I politely decline,

I get the accusatory stare-down.

I am tired of wearing a mask. No, it is not as bad as the compulsive

hand sanitizing, but plain annoying for me. They are uncomfortable and

unattractive. The worst part though is they are DAMAGING what little human

interaction we have left.

I am tired of having to search all through my phone to find

the QR code that confirms I am fully vaccinated.

I am really tired of watching friends’ weddings and funerals via ZOOM –

seriously could we get any COLDER??!!!

I am tired of hearing “the new normal.” People

say this as if this is as good as it is going to get.

NO! Absolutely NO!!! I

will not accept this.

Over the past few days of the Convoy to Freedom gaining

steam, I have seen people comment things like.

“They should just get vaccinated or change jobs.”

“I don’t get what they are protesting, I still have all my

freedoms.”

Really? It has been two years and already you have forgotten

that; wearing a mask, showing vaccine passport, not being able to attend a

wedding or funeral – are not normal things and they certainly are not “freedom.”

And why should they have to change jobs? Them or any other

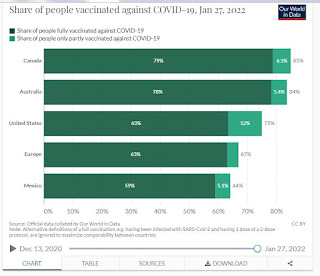

unvaccinated. We have known from the very start we would never achieve 100% vaccination

rate – no country will. Canada and Alberta DO have one of the worlds’ highest

rates of uptake. There is no reason to discriminate against this minority. Once

the restriction mandates are lifted, no ones’ vaccine status will matter.

And then there is the travel aspect – I am tired of this on several fronts.

One - We operate a vacation rental (Galloway Nest). We used to host US and internationals guests, that market has evaporated.

Two - Traveling to most places is not too hard, it is coming home that is the challenge. We recently drove to the States for a short vacation. Crossing the border into US there was not one question about vaccination. Just showed our passports (regular passport, not vaccine one) and answered questions about where/who we were visiting.

To return to Canada though we had to get a “re-entry test” and load this to the ArriveCan App with all our other vaccination details within 72 hours prior to return. Unfortunately, when we arrived at the border, we hadn’t received out test result… and the 72-hour window was closing.

This is

when the most bizarre thing happened – the Canadian Border Service Agent deemed

us “unvaccinated.” This meant we had to

enter the full quarantine protocol. It’s no wonder no one is travelling to Canada. If we, as fully vaccinated Canadians must go

through all of this, I cannot imagine what foreigners have to go through.

Three - Australia. I can’t even write about this, it’s too upsetting.

I will say if you have been able to hug your grandkids in the past three years you better

damn well be grateful.

We no longer have the freedom to do this!

I know it’s been hard for media and the public alike to define

what the Freedom Convoy is all about. I think though, like me, the truckers in

the Freedom Convoy are likely tired. The people who have chosen to join them are

likely tired. The supporters at the roadsides waving, and supplying food are

likely tired. You might not be there

yet, maybe you can live more years like this; but I can’t, they can’t.

We really didn’t need to look any farther than the name to

define what this is about it’s right there, Freedom Convoy.